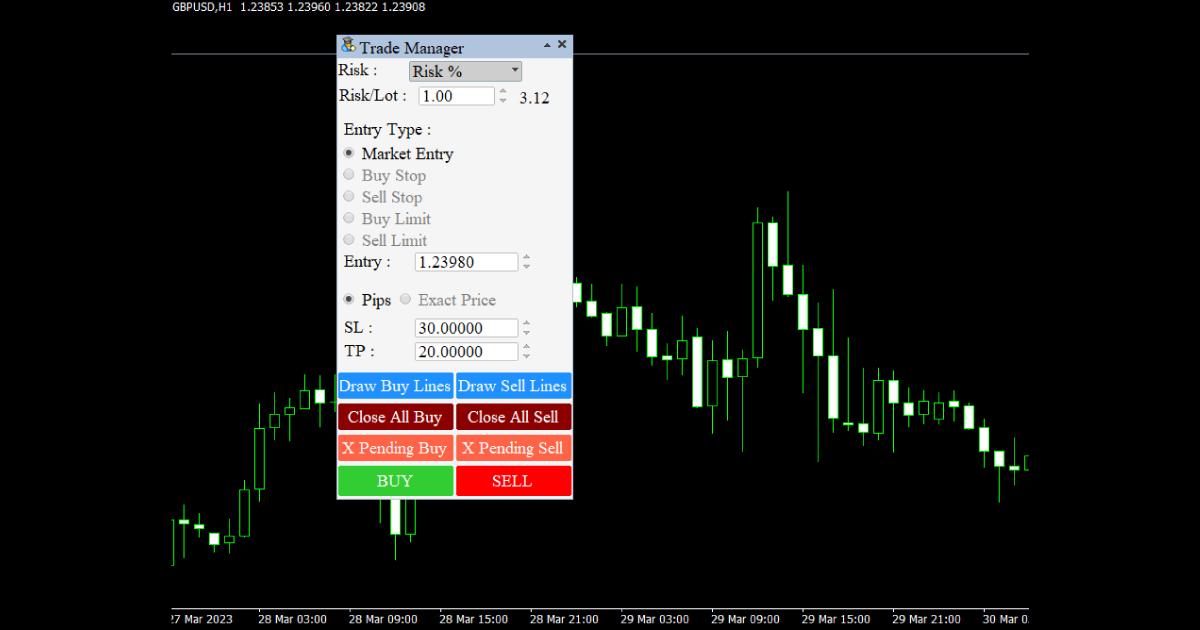

A “Trade Manager” typically refers to a software or tool used by traders, particularly in financial markets like stocks, forex, or cryptocurrencies, to assist in managing their trades. Trade managers are designed to help traders with various aspects of trade execution, monitoring, and risk management. Here are some common features and functions of trade managers:

- Order Placement: Trade managers often allow traders to place orders directly from the software, including market orders, limit orders, and stop orders.

- Trade Monitoring: They provide real-time monitoring of open trades, showing essential information like entry price, current price, profit or loss, and other relevant data.

- Risk Management: Trade managers often include features for setting stop-loss and take-profit levels to help control potential losses and secure profits.

- Position Sizing: Some trade managers help traders calculate the appropriate position size based on their risk tolerance and the size of their trading account.

- Trade Analysis: They may provide tools for analyzing trade performance, including metrics such as win-loss ratios, average profit/loss, and other trade statistics.

- Trade Journaling: Some trade managers allow traders to keep detailed trade journals, which can help them review and improve their trading strategies over time.

- Automation: Advanced trade managers may offer automation features, enabling traders to implement algorithmic trading strategies or set conditional orders.

- Risk Reward Analysis: They often provide tools for assessing the risk-reward ratio of a trade, helping traders make informed decisions.

It’s important to note that there are various trade managers available, and their features can vary significantly. Some forex trade manager are standalone desktop applications or web-based platforms, while others may be integrated into trading platforms or provided by brokers.

Benefits of using a trade manager:

There are a number of benefits to using a trade manager, including:

- Save time: Trade managers can help traders to save time by automating trading tasks and providing real-time information on open and closed trades.

- Improve risk management: Trade managers can help traders to improve their risk management by allowing them to set stop-loss and take-profit orders and by generating risk reports.

- Make more informed trading decisions: Trade managers can help traders to make more informed trading decisions by providing them with real-time market data and historical trading data.

Traders often use trade managers to streamline their trading processes, reduce the likelihood of costly errors, and maintain discipline in their trading strategies. The choice of a mt4 trade manager depends on a trader’s specific needs, trading style, and the financial markets they are active in.

Metatrader 4 Expert Advisors (EAs): Automating Success:

Expert Advisors (EAs) are powerful tools within the MetaTrader 4 (MT4) platform that bring automation to trading. In this section, we’ll uncover the mystery behind EAs and delve into their essential role in automating trading strategies.

Expert Advisors are essentially software programs that can analyze markets, generate trading signals, and execute trades automatically. They are designed to remove the emotional element from trading decisions and follow predefined rules or algorithms.

Benefits of Combining EAs with MT4 to Streamline Trading Operations:

The combination of EAs with MT4 offers numerous advantages that can significantly streamline trading operations:

- Precision and Consistency: EAs execute trades with precision and consistency, ensuring that trading strategies are followed without deviation.

- Speed and Efficiency: Automated trading is lightning-fast, enabling traders to capitalize on opportunities that might be missed with manual trading.

- 24/7 Trading: EAs can trade around the clock, even when traders are asleep or away, taking advantage of global market movements.

- Backtesting: EAs can be tested and optimized using historical data, allowing traders to fine-tune their strategies for better performance.

How to Use EAs Effectively for Risk Management and Strategy Execution:

Effectively using EAs involves understanding risk management and optimizing strategy execution:

- Risk Management: EAs can be programmed to apply strict risk management rules, including setting stop-loss and take-profit levels, controlling position sizes, and limiting overall exposure. This helps protect capital and manage risk effectively.

- Strategy Execution: To use EAs effectively, traders should define clear trading strategies and rules. These rules can be translated into algorithms that guide the EA’s behavior. It’s crucial to monitor and adjust EAs as market conditions change.

- Continuous Monitoring: While EAs can operate independently, they still require regular monitoring. Traders should stay informed about market news and be prepared to intervene or adjust their EAs if necessary.

- Customization: EAs can be tailored to suit a trader’s specific objectives and risk tolerance. Customization ensures that the EA aligns with the trader’s goals and preferences.

Expert Advisors in MetaTrader 4 offer traders the opportunity to automate their strategies, improve precision, and streamline trading operations. When used effectively, EAs can be powerful tools for risk management and strategy execution, potentially contributing to trading success. However, it’s essential for traders to have a solid understanding of their chosen strategies and continuously monitor and adjust their EAs to adapt to changing market conditions.

Conclusion:

By harnessing the power of MetaTrader 4, complementing it with indicators, EAs, and a reliable trade manager, traders can significantly enhance their potential for success. With the added support of 4xPip’s trading resources, traders are well-equipped to secure good profits and navigate the dynamic landscape of trading. This comprehensive approach promises not only efficiency but also improved decision-making and risk management, setting the stage for a more successful trading journey. There are a number of different trade managers available, both free and paid. It is important to choose a trade manager that is compatible with your trading platform and that meets your specific needs.